Table of Contents

If you have heard about cryptocurrency and crypto trading platforms then you most likely have heard about Binance too. Binance is one of the first and most popular cryptocurrency trading platforms in the world. Crypto enthusiasts are using Binance all around the world. Besides trading, there are several other methods of making money on Binance, and you don’t need to have any special skills.

How to start?

First of all, you need to have an account on Binance. You can register your account for free, and it will take around 2-5 minutes.

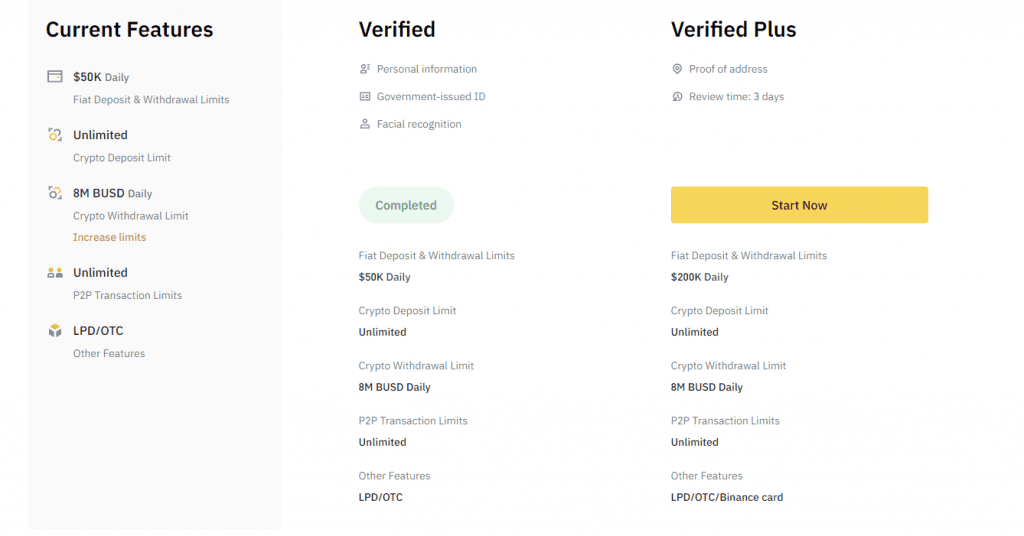

You can sign up with your phone or email. After you finish the registration I will recommend you verify your account in the security tab. Verified accounts have more benefits.

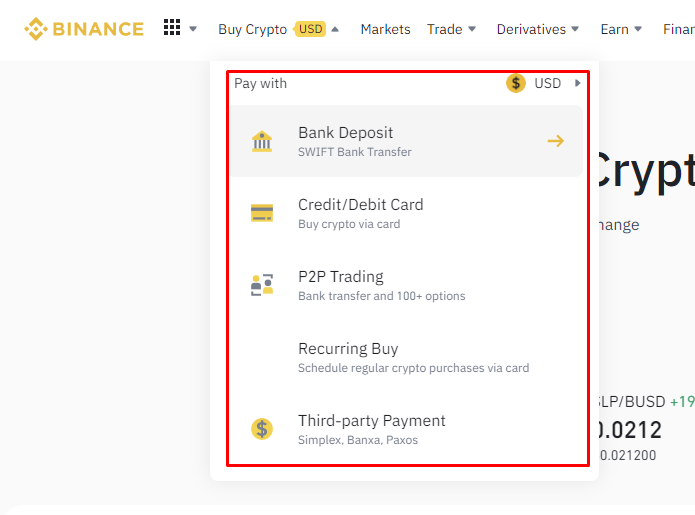

Then you will need to deposit some cryptocurrencies. You can do it by transferring them from another wallet if you have, or you can buy crypto and pay with Bank Deposit, Credit/Debit Card, P2P Trading, etc. Also, you can choose the currency.

Making Money on Binance

So, now your account is set up, and you are ready to learn about different methods of making money on Binance.

The essential way of making money on Binance is trading. I will skip it because probably you are already familiar with it.

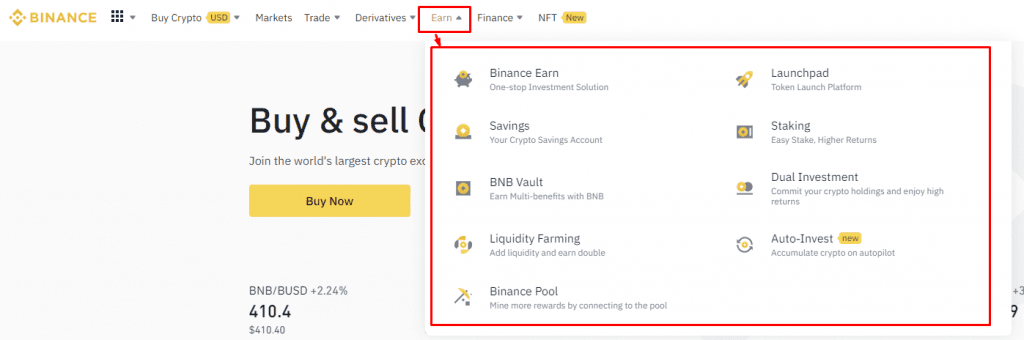

Here will discuss other methods with different levels of risk and different possible percentages of profit. If you look at the main menu on the Binance dashboard you will find the ‘Earn’ tab.

Main methods of making money on Binance:

- Binance Earn

- Savings

- BNB Vault

- Liquidity Farming

- Binance Pool

- Launchpad

- Staking

- Dual Investment

- Auto-Invest

If be honest, if you click on the Binance Earn, you will get all earning methods on the same page. In other words, all methods mentioned above are Binance earn methods.

Staking

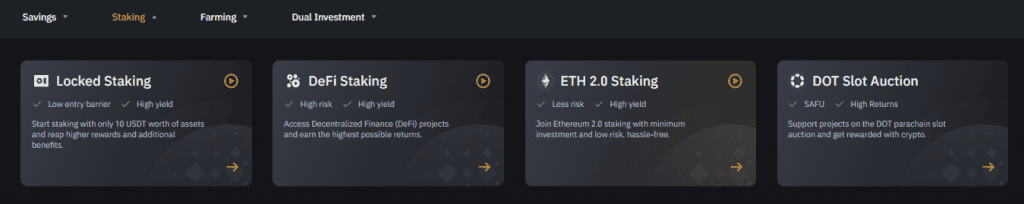

Let’s start with staking. Staking suits best to those who are new to crypto, or who are looking for earning ways with less risk.

What is staking? Basically, staking is freezing your money. Binance pays you interest for staking cryptocurrency. Staking duration can be different and the APY rate varies depending on the period of staking.

There are different staking options on Binance, so you can choose any option that you like. You can watch a short video tutorial about each staking method by clicking on the yellow ‘play’ button on the top right corner of each staking tab.

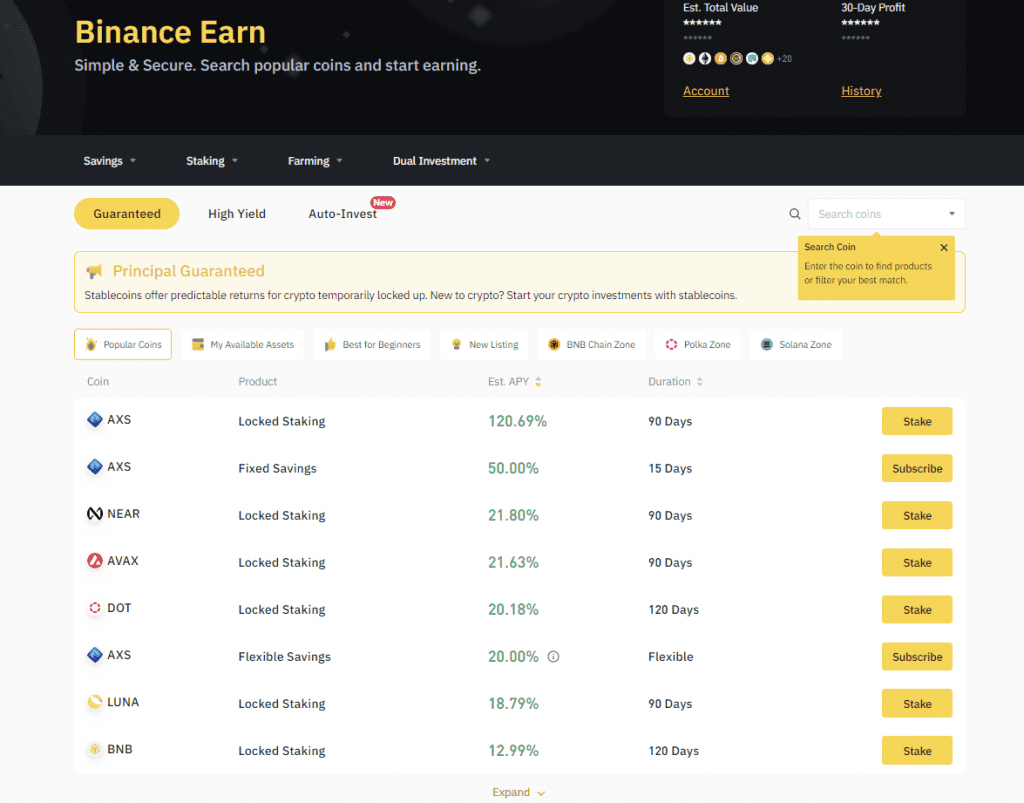

I prefer locked or Defi staking. Right now, there is a staking quota for AXS tokens with 120.69% of APY for 90 days. I think it is a very good %. How much interest do you get when you ‘stake’ your money in the bank?!

Savings

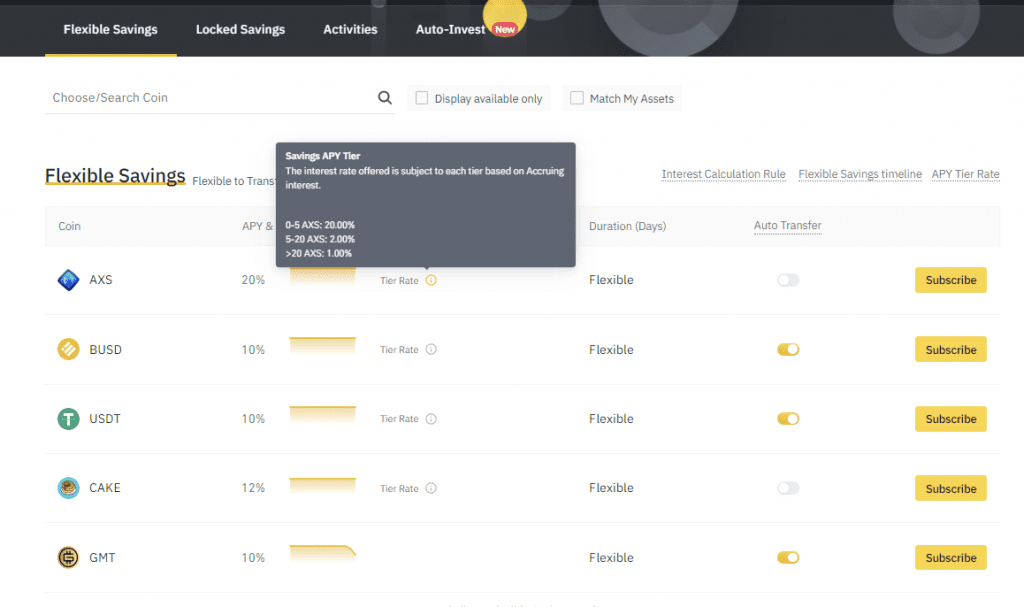

In general, savings work in the same way as staking. Savings can be locked and flexible. Flexible Savings is your Crypto savings account when you subscribe your crypto to earn interest, with the flexibility to redeem your funds at any time. On the other hand, locked savings is a subscription of your crypto for a fixed period of time.

Locked savings have a higher yield rate, so if you don’t plan to use your crypto for a while, then it will be more profitable to use locked savings.

If you use flexible savings, you will get interest distribution every day. You can use auto transferring, so the available balance of your Spot wallet will be used daily to subscribe to Flexible Savings.

BNB Vault

BNB Vault is a BNB yield aggregator. Depositing BNB means participating in Launchpool, Savings, Defi staking, and other projects and at the same time gaining rewards. In other words, holding BNB on Binance gives you a multi-benefit.

One of my favorite things about holding BNB on Binance is token distribution. When a new token/project is launched on Binance, BNB holders have a chance to get that token.

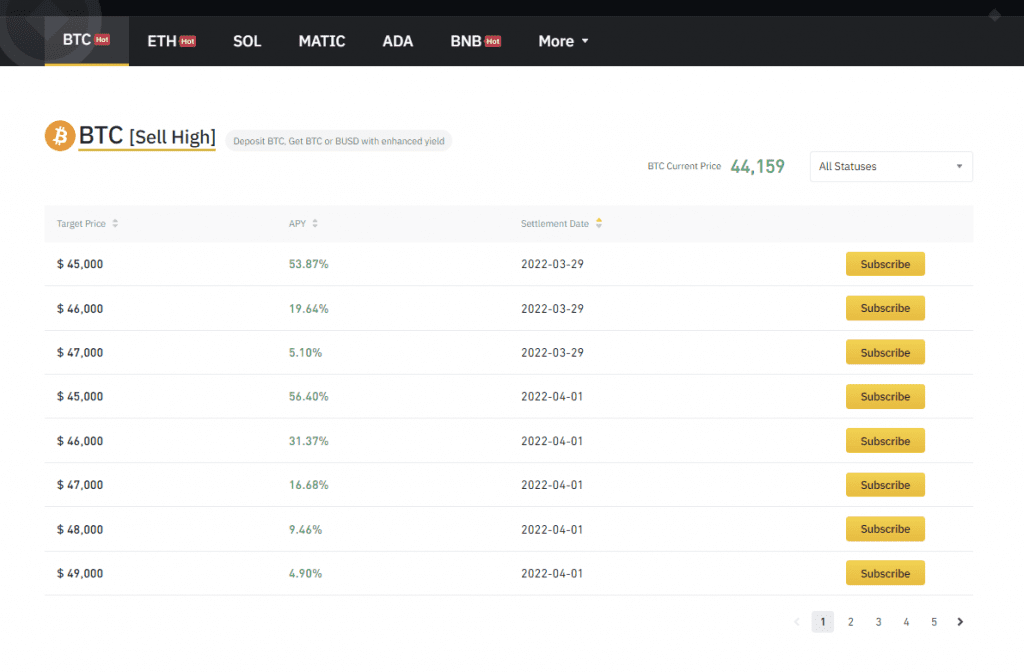

Dual Investment

Dual Investment is a non-principal protected structured saving product with enhanced yield, involving two different currencies. Upon subscription, you select the underlying asset, the deposit currency, subscription amount, and settlement date.

Your return will be denominated in the deposit currency or alternate currency, depending on the following conditions.

There are two types of Dual Investment products: Sell High and Buy Low.

For the ‘Sell High’ product, this means that if the Settlement Price is above the Target Price, the product is “exercised”. And the product is “not exercised” if the Settlement Price is below the Target Price.

For the ‘Buy Low’ product, this means that if the Settlement Price is below (down) the Target Price, the product is “exercised”. But if Settlement Price is above the Target Price, then the product is “not exercised”.

For both types of Dual Investment products, you will receive the returns in deposit currency if the product is not exercised. You will receive the returns in alternate currency if the product is exercised.

To subscribe your assets for the dual investment you need to pass a short quiz first. The correct answers on the quiz you can find at the end of that post.

Auto-invest

Auto-Invest allows you to automate crypto investment and earn passive income. It is a dollar-cost averaging (DCA) investment strategy.

How does it work? Basically, you choose the cryptocurrency you want to purchase on a regular basis. Then you need to create a plan by choosing how much you want to buy and how often, and selecting your preferred stable coin. Your purchased crypto will be automatically deposited into your Flexible Savings account. Therefore, you can earn passive income with your investments.

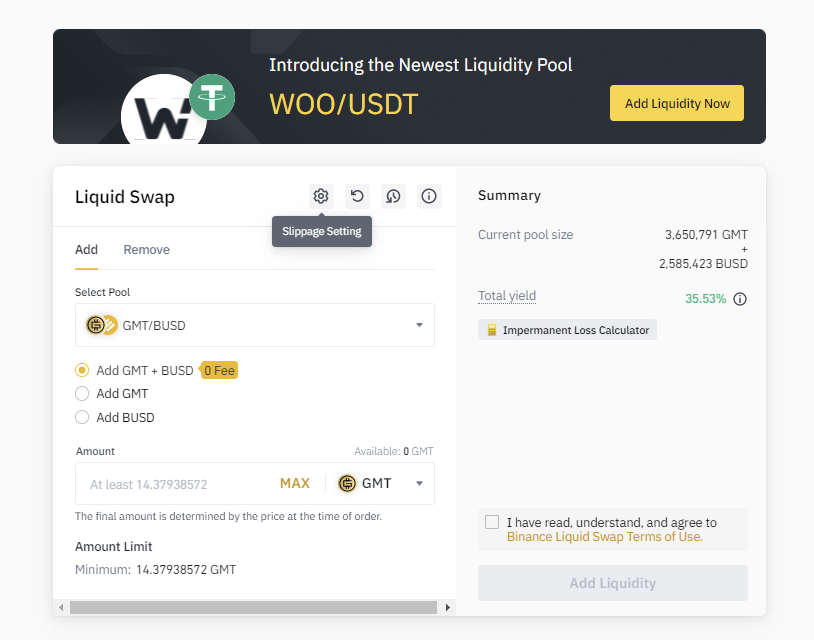

Liquidity Swap

Liquidity Farming is a liquidity pool developed based on the Automatic Market Maker (AMM) principle. Just like any other DeFi swap, it consists of different liquidity pools, and each liquidity pool contains 2 digital tokens or fiat assets.

You can provide liquidity in the pools to become a liquidity provider and earn transaction fees and flexible interest. In addition, you can swap two digital tokens or fiat assets in the liquidity pools easily.

To subscribe your assets for the liquidity swap you need to pass a short quiz first. The correct answers on the quiz you can find in the next section.

Liquidity Swap quiz answers

To participate in Liquid Swap on Binance, users need to complete the “Liquid Swap Tutorials & Questions” quiz. There is a tutorial video that will help you to understand the Liquidity swap better. But if users are inexperienced, they may find it challenging to answer the questions. So, here are the answers to this test.

1. “Liquid Swap” is a product developed on which of the following design principles:

AMM (Automatic Market Maker)

2. Is “Liquid Swap” a guaranteed investment?

No, a loss may incur.

3. When you provide liquidity, which of the following views is incorrect:

Any token can be added

4. In the current BUSD / DAI pool, the pool price is 1 BUSD:1 DAI. If you trade 10,000 BUSD into DAI, the system prompts you that there will be a 3% slippage in this transaction. If the transaction is successful, you will lose due to slippage:

≈ 300 USD

5. When you add 100 BUSD to a BUSD / DAI liquidity pool (the current pool ratio is 4:6 / BUSD: DAI), what tokens will you hold (if transaction fee and slippage are not considered):

c. A portion portfolio, including 40 BUSD + 60 DAI, and the portion portfolio will change in real-time.

6. When you remove your tokens back, which of the following views is incorrect:

a. You can get the same amount of tokens you added.

7. Which of the following may cause transaction fees:

All of the above.

8. In “Liquid Swap” for providing liquidity, there are several situations that may cause losses:

All of the above.

9. “Liquid Swap” is NOT a guaranteed investment, after providing the liquidity, the maximum loss you may incur is:

More than 50%

10. Regarding the number of portions, the portion value, cost per portion, and unrealized profit and loss, which of the following is incorrect:

The number of portions changes in real-time, but the value of portions remains constant.

Don’t worry. Even you failed to complete the quiz the first time, you will have a chance to do it again. Also, after submitting the answers all wrong answers will be shown.

Dual Investment quiz answers

1. What kind of product is Dual Investment?

Investment product where users have a chance to sell high or buy low at their desired target price on the desired settlement date which does not guarantee a minimum return

2. What is the Target Price and Settlement Date in Dual Investment?

Target Price = the price at which I want to buy or sell cryptocurrency

Settlement Date = the date at which I want to buy or sell cryptocurrency

3. Once I subscribe, will my Target Price ever change?

The target price will not change once subscribed

4. I am hoping to sell my 1 BTC for 52,000 BUSD. I subscribed to the BTC Dual Investment “Sell High” product with a $52,000 Target Price to sell BTC.

At the Settlement Date, the BTC price is $52,500. How much will I receive at the end?

52,000 BUSD + interest yield in BUSD

5. I am hoping to buy 1 BNB at 330 USDT. I subscribed to BNB Dual Investment “Buy Low” product with a $330 Target Price to buy BNB.

At the settlement Date, the BNB price is $345. How much will I receive at the end?

330 USDT + interest yield in USDT

6. What are the risks of Dual Investment?

The risk is that if the market price on the Settlement Date goes far below my Target Price to buy, I am buying at a relatively higher price and vice-versa.

Summary

As you can see there are lots of different ways of making money on Binance. And if you have free stablecoins of Defi on your wallet, so you can start getting passive income. You can choose a method with low risks or high risks. Most investment methods with high risks have a higher APY.

You can find more information on the Binance website.